What Is the Future of Crypto Mining & PoW Following the Ethereum Merge?

A deep dive into the future of Proof of Work crypto mining post Ethereum's move to Proof of Stake in 2022. An optimist’s outlook...Is There a Business Case for Crypto Mining Now Ethereum is PoW?

If you are on this page, chances are that you know what crypto mining is. If you are a GPU miner or interested in GPU mining, you’re probably wondering about the future of crypto mining now that the most profitable coin, Ethereum, can no longer be mined.

You may be asking yourself whether the “Ethereum merge” has well and truly killed off Proof of Work mining for good and whether all other cryptocurrencies will follow in Ethereum’s footsteps. If that’s you and you’re looking to gain some insight into the future of crypto mining, please jump to ‘is crypto mining dead’.

If you are new to the space and have stumbled across this article, please see our explanation of crypto mining here.

For everybody else, please read on.

What is the Ethereum Merge (aka Ethereum 2.0)?

As the second largest cryptocurrency, you will most likely have heard about Ethereum and maybe heard the term “Ethereum merge” bounced around. You may have also heard this referred to as ETH 2.0 or ETH PoS.

Ethereum is the world’s second largest cryptocurrency behind Bitcoin and has seen some phenomenal price growth in recent years, which has caused the crypto mining space to explode. Ethereum’s growth is largely because it’s already widely used/adopted, has a strong roadmap, an engaged community and some excellent use cases.

Up until the “merge”, Ethereum was also the most popular and profitable crypto to mine. However, this all changed in September 2022, when after many years of planning (and delays), the project switched from Proof of Work (PoW) to Proof of Stake (PoS). The impact being that ETH as a currency could no longer be earned through crypto mining. For miners, the future of crypto mining seemed a lot less clear all of a sudden.

To understand this better, jump to the differences between PoW and PoS mining.

Why did the Ethereum merge happen?

The main reason given by Ethereum’s spoke’s person Vitalik Buterin on Twitter was to “reduce worldwide energy consumption”:

Vitalik Buterin claims the ETH merge will reduce worldwide energy consumption – https://twitter.com/VitalikButerin/status/1570299062800510976

A whole white-paper could be written around the pros and cons and legitimacy of this change. For starters, the impact on de-centralisation, whether the figures are actually correct, comparisons to other financial/tech industries that consume power, the motives behind the switch and whether they are environmental, political or both…

Clearly, some Tweeters disagree on the figures shared.

The project has big investors and stakeholders, so it’s hard to believe that the move is entirely innocent and “green” in its motives. A project which felt very community-driven has now more of a more centralised commercial machine which is influenced by a few key players.

There is a lot more than could be said, but the cold hard truth is that now the Ethereum merge has taken place, the most profitable cryptocurrency can no longer be mined.

As a result, more questions are being asked about the future of crypto mining, PoW, and above all else, is crypto mining dead? This is something we will explore at length in the subsequent sections.

How did the Ethereum merge impact crypto mining?

Following the merge, miners realised they had three options:

- Pack up their crypto mining equipment in the hope things will change

- Give up and sell their equipment

- Continue to mine other cryptocurrencies

The following Reddit thread, ‘Where have ETH miners gone — 3 weeks after the Merge’, explores what actually happened after the Ethereum merge.

The data suggests that only 24.88% of the former Ethereum miners have continued mining and a whopping 68.1% have stopped mining:

Where did the mining power go pre and post Ethereum merge<br/>Image credit – RxBrad /

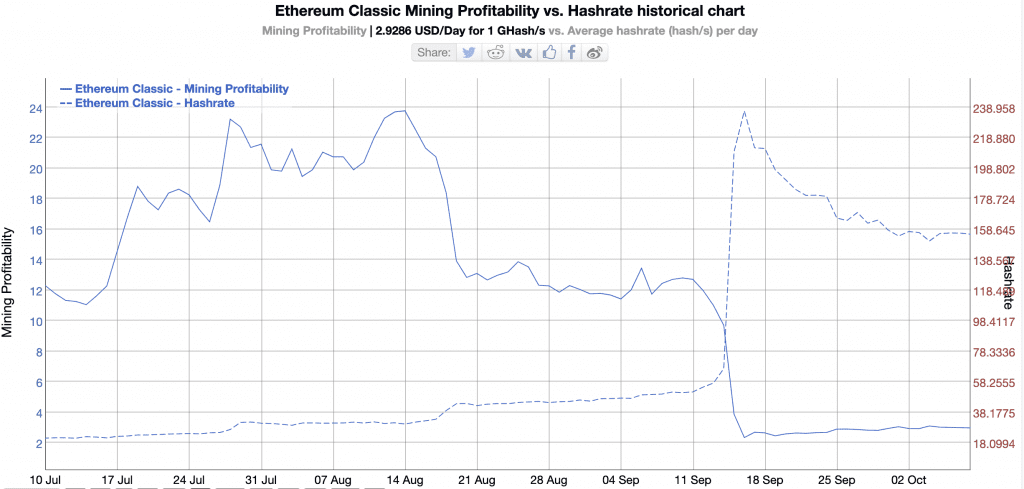

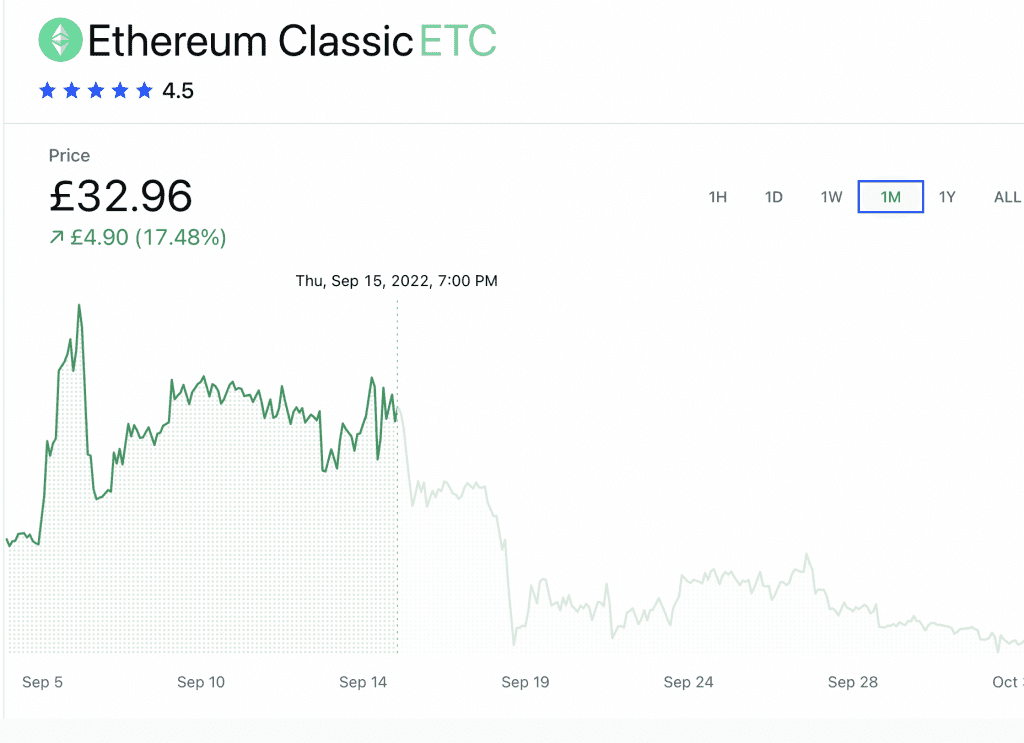

Despite the data above, a significant amount of Ethereum’s “mining power” still went into other coins. To give one example, the below data from https://bitinfocharts.com shows how Ethereum Classic’s mining profitability vs network hashrate over the last three months:

Ethereum Classic mining profitability vs. hashrate chart over three months

We can see an a very clear correlation between the two. On September 15th, when the Ethereum merge happened, Ethereum Classic (ETC), which continues to be minable, saw it’s profitability reduce in almost direct proportion to the increase in network hashrate.

ETC got the large majority of Ethereum’s hash rate, followed by others, which we cover later in what is most profitable to mine post the Ethereum merge.

Before we go any further exploring the future of crypto mining, we thought it would be useful to evaluate whether crypto itself is doomed for failure, or whether it still has a bright future.

Does crypto even have a future? The pros and cons of crypto

Let’s look at some of the pros and cons of crypto as a whole.

Crypto pros

Firstly, the crypto pros. There are lots of opportunities and great things ahead for crypto. Not least the following:

- Exciting technological advancements and roadmaps for crypto initiatives. Maybe ironically, given we are discussing the future of crypto mining, but the Ethereum merge is a great example of a crypto initiative which is at least trying to address governmental and environmental concerns over the power required to mine crypto. Putting aside any arguments over centralisation vs decentralisation, Ethereum is sticking to its roadmap and has enormous growth and adoption potential. It’s likely ETH will take off in a big way when the economy recovers and current bear market ends.

- Inflation, failing fiat currencies and devaluation of the pound/euro. Not all crypto projects are intended to be a store of value/currency and many provide innovative use cases and solutions to solve real-world problems. That said, most do have an accepted value and can be traded on exchanges, a bit like a share can be purchased for a company on the stock exchange. However, with traditional fiat currencies like the pound and euro plummeting and living costs going up, more people (including governments) are questioning whether cryptocurrency provides the answer, especially given some of the obvious benefits e.g. limited supply, deflationary, smart contracts, and so on… It’s for this very reason, that El Salvador has taken the bold move to make Bitcoin legal tender with president Nayib Bukele recently mocking the Bank of England.

Nayib Bukele recently mocking the Bank of England.

- New and exciting crypto projects entering the market every day. Believe it or not, it’s still very early days for crypto. The industry is ripe with innovation and visionaries. Other projects like Ethereum will emerge and learn from their predecessors to become bigger and better. Some may be more suited to Proof of Stake but others like Bitcoin will always require the benefits provided by Proof of Work mining and this is one of the biggest reasons why crypto mining still has a bright future!

- The current bear market will become a bull market again. Right now, many investors and miners have seen their crypto portfolios drop 50-90% of their value in recent months. This may sound unthinkable, but its happened many times in the history of crypto. The data here shows various points at which Bitcoin’s price has dropped between 50-99% since June 2011. It’s important to realise that the stock market is also suffering the same fate, with many technology stocks seeing similar drops. More recently British stocks have plummeted as well. All economic markets go through cycles and most recover stronger than ever further down the line. It’s a process of natural selection to weed the weak out from the strong.

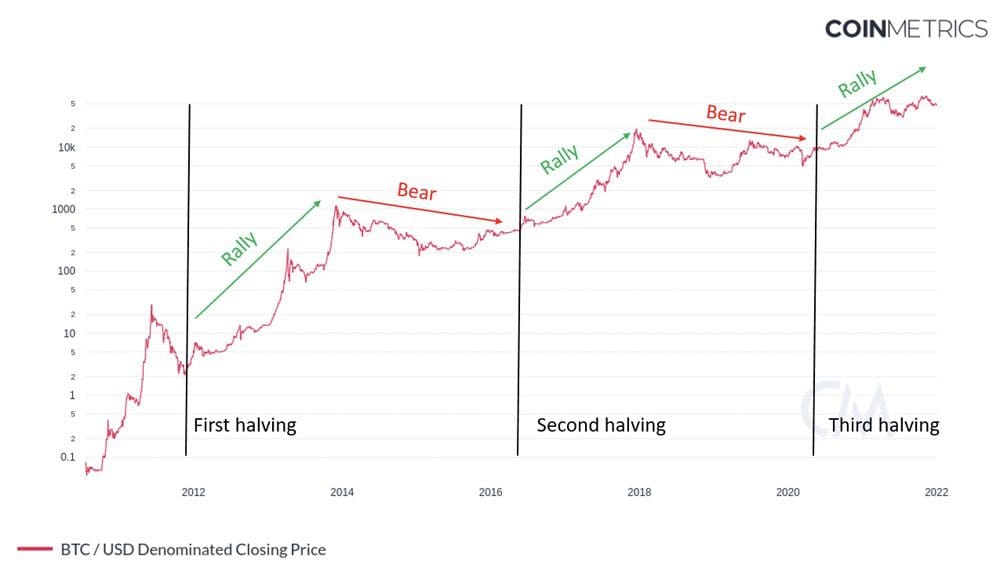

Our prediction is that the crypto market will recover following the Bitcoin halving in 2024, which is a view shared by others. Historically, crypto has always gone on to a strong rally after the Bitcoin halving events and there is no reason to think 2024 will be any different.

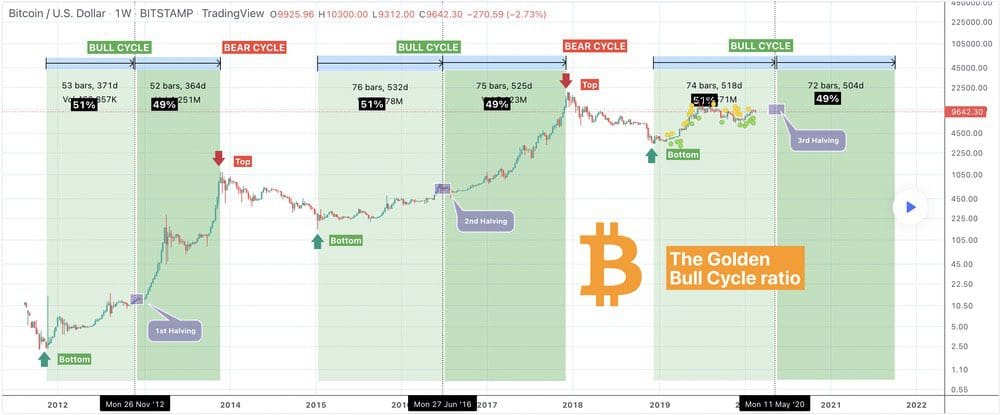

Here are a few charts to highlight the historic price pattern of Bitcoin before and after the halving events:

Simple chart showing how Bitcoin bear and bull runs have coincided with the halving event Image credit – https://bitcoinmagazine.com/markets/bitcoin-bear-markets-what-why-when

This chart focusses estimates the remaining days of the current Bitcoin cycle based on tops and bottoms of previous cycles. Image credit – https://www.tradingview.com/chart/BTCUSD/QBeNL8jt-BITCOIN-The-Golden-51-49-Ratio-600-days-of-Bull-Market-left

Crypto cons

Now, the crypto cons. Sadly, for each of the pros above, there is an opposing view:

- Many legitimate crypto projects fail. It’s true that while we have exceptional crypto projects like Etherem, Bitcoin, Cardano, Solana (the list goes on), there will be failed projects like Terra LUNA. The collapse of Terra LUNA is just one recent example which made (and is still making) headline news. Many investors lost a lot of money when the project failed. It came out of nowhere and caught even the most seasoned crypto investors and enthusiasts off guard. The lesson learnt is that nothing is certain in the world of crypto and a degree of resilience is always required. Always remember, with any kind of investing – it’s never a good idea to put all of your eggs in one basket and never invest more than you can afford to lose.

- CBDC (Central Bank Digital Currencies) are a safer version of crypto. We’ve recently produced a detailed guide exploring CBDCs vs cryptocurrency. Please feel free to visit the link for more information, but in short, CBDCs are intended to provide a digital currency replacement to traditional fiat currency or cash. These will be digital currencies that governments control. In all likelihood, these CBDCs will be subject to digital money printing and inflation much the same as the current financial system is, but with much greater controls in place as to monitor when/where/how you can spend your money.

- The crypto market is not impervious to scams and Ponzi schemes. Sadly, crypto scams are at the forefront on many people’s minds when thinking about crypto. It’s often very difficult to distinguish a scam from a genuine and innovate project. For this reason, we’ve covered the topic of crypto scams and ponzi schemes in depth, to try and help people steer clear of these. Suffice to say that crypto scams are a legitimate concern and care always needs to be taken when investing in crypto.

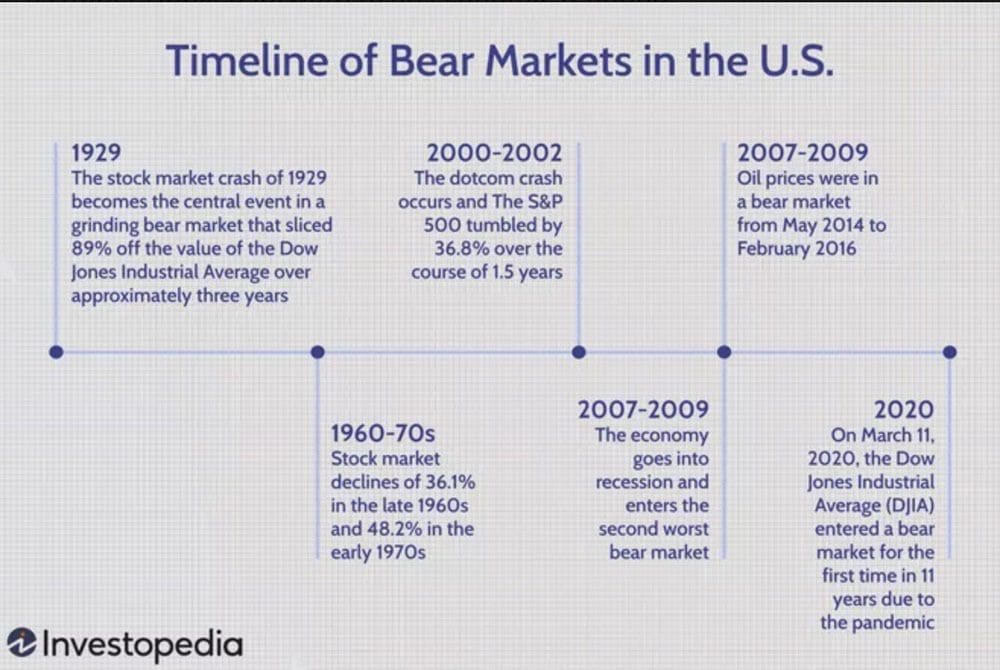

- The current bear market could go on for a long time. With high levels of inflation and living costs (especially energy) going up, many investments in stocks/crypto (and subsequently pensions) are going down. We’ve not long come out of the COVID-19 pandemic, now the Ukraine war together with possible further conflict with Russia, makes it very difficult to foresee an end to the current economic turbulence. Sometimes these bear markets can go on for years, approaching on decades, but they do end.

The chart below shows a timeline of some of the most well-known bear markets in the United States:

Image credit – Investopedia / Sabrina Jiang

It’s probably clear from the above cros and cons of crypto, that we are still strong advocates of crypto and believe it has a rocky but exciting future ahead.

Is crypto mining dead?

Now on to the main topic. What is the future of crypto mining? Is crypto mining dead?

Is GPU mining dead?

Before we go further, we need to distinguish between the different types of crypto mining. For the purpose of this article, we are referring mainly to GPU mining, which uses PoW.

However, we also have CPU mining and ASIC mining (most comonly used for mining Bitcoin), both of which also use PoW. There are also other forms of crypto mining like PoC (Proof of Coverage) which is used for Helium (HNT) mining.

The question of whether mining is dead has been a heated topic in the crypto mining world recently. With the Ethereum merge and switch from Proof of Work to Proof of Stake, the most profitable coin to mine with a GPU, ETH, is no longer minable.

Does this mean that crypto mining is dead? Sadly, many smaller crypto miners have decided on this answer – and they have concluded that crypto mining is indeed dead. Many of them have either packed up their mining equipment or sold everything to try and recover part of their investment.

This is a legitimate concern right now but perhaps a short-sighted view given many of the crypto pros mentioned above and possibilities for the crypto mining landscape to change.

The following Facebook group is a source of knowledge, ideas and laughter at times. The following post generated a lot of discussion on this topic and things certainly got heated.

Facebook user says I’ll keep mining anyway as prices will go up

The consensus was that the above post was a flawed view. In fact, the moderator needed to disable commenting as some individuals were getting quite aggressive and resorting to insults. Others tried to be very helpful and explain why they felt this was a flawed view by clearly outlining/comparing how more income could be generated without mining.

On the whole, people seemed to agree that it’s ‘nice’ to support a project but most miners are in it to make money. And, if you’re in it to make money, you are better off simply using what you would normally spend on electricity to purchase crypto directly.

It’s very hard to argue with this given everything explored above. However, please keep reading as it’s not the end of the story.

The most important thing to realise is that we have been here before.

But what does “been here before” mean?

Well firstly, people have been claiming that “crypto mining is dead” since the very beginning (well almost).

We can check this by using some simple Google search operators around the terms “crypto” and “mining is dead” and the results reveal:

- Before 2014 – “mining is dead” – 7 times

- 2014 – 2017 – “mining is dead” – 317 times

- 2017 – 2019 – “mining is dead” – 1,170 times

- 2019 – 2021 – “mining is dead” – 1,750 times

- 2021 and beyond – “mining is dead” – 6,090 times

We can also do the same using “gpu” and “mining is dead”:

- Before 2014 – “mining is dead” – 7 times

- 2014 – 2017 – “mining is dead” – 8 times

- 2017 – 2019 – “mining is dead” – 7,100 times

- 2019 – 2021 – “mining is dead” – 8,280 times

- 2021 and beyond – “mining is dead” – 14,500 times

Admittedly, most of these were post 2021, but that’s to be expected given the huge surge in crypto prices along with the awareness and popularity of crypto mining around this time.

The results above need to be taken with a pinch of salt, but they do show that claiming crypto is dead is far from new.

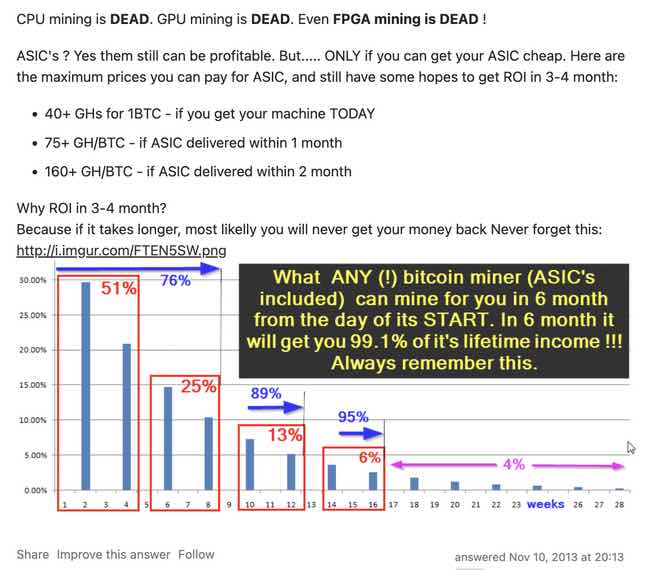

Below shows an example found on https://bitcoin.stackexchange.com from 2013, which is quite typical of the kinds of claims that have been made throughout the history of crypto mining.

An answer on https://bitcoin.stackexchange.com from 2013.

Clearly crypto mining didn’t die in 2013, but it may have felt that way at the time and for this particular miner. The point being made is that these kinds of remarks may feel very true at the time but this is only due to our human tendency to have a short-sighted view of things.

We can see similar patterns to above when searching across social platforms like Reddit as well. The death of crypto mining has been a hot topic for a long time.

Is ASIC and Bitcoin mining dead?

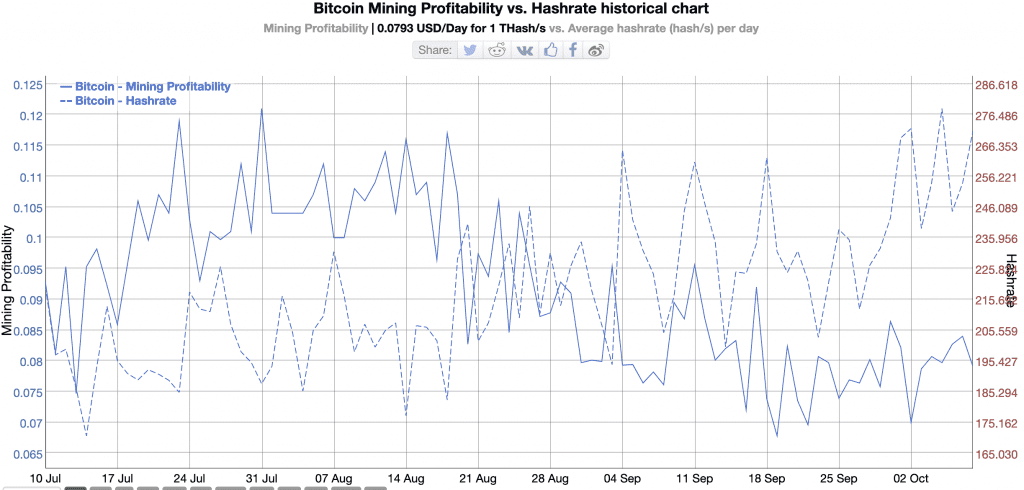

We can see from below, in a chart similar to the one showing Ethereum Classic’s decline in profitability, Bitcoin’s hashrate has also gone up and the profitability has come down over the past three months.

However, unlike Ethereum Classic, this is by a relatively small amount compared to historical standards for Bitcoin. The change also doesn’t seem to coincide with the September 15th Ethereum merge date, as it seems to happen around a month earlier. What’s possible is that a small proportion of Ethereum miners bailed ahead of the merge date and swapped over to mining Bitcoin, which led to the increased hashrate:

Bitcoin mining profitability vs. hashrate over 3 months

Image credit – https://bitinfocharts.com/comparison/mining_profitability-hashrate-btc.html#3m

For Bitcoin mining using ASICs, there appears to be a small correlation between profitability/hashrate and Ethereum’s switch to PoS. However, the longer term implications on Bitcoin mining are unclear as the battle between PoS and PoW continues.

Has crypto mining always been profitable?

Firstly, lets think about the simple economics of crypto mining –

To be profitable at any given time, you need to be earning more than it is costing you to mine.

It’s more complex than this of course, as we need to also factor many other things, including how much the mining equipment cost (usually fixed), energy costs (which are variable), pool and exchange fees, and so on.

For the purpose of illustrating whether crypto has always been profitable to mine, we can get an idea thanks to https://bitinfocharts.com:

Ethereum and Ethereum Classic

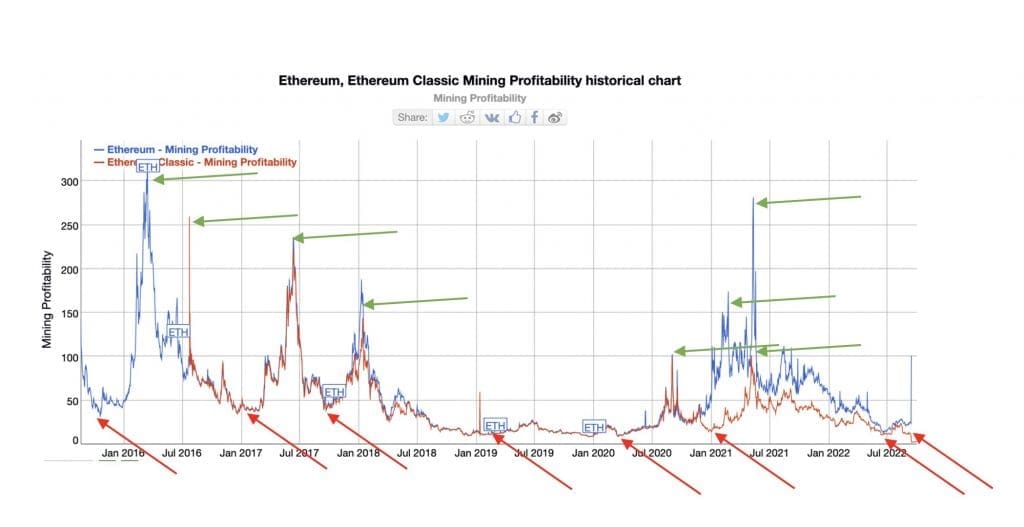

Of course, Ethereum can no longer be mined, but it’s still useful to see the historic data. The following chart plots the peaks and throughs in mining profitability for both Ethereum (ETH) and Ethereum Classic (ETC). The latter, the original Ethereum before the DAO fork, which is still very much minable using GPUs.

What we can see below, is that both ETH and ETC have followed a similar journey between 2016 and present. There have been many profitable periods/peaks and many low points, like now.

ETH and ETH profitability 2016 to 2022

Image credit – https://bitinfocharts.com/comparison/mining_profitability-eth-etc.html#alltime

It’s difficult to tell from the chart above, but for ETC, we are currently at 3.011 USD/Day for 1 GHash/s. Most of December 2018 to March 2020 was spent in a similar range and struggling to get much above double digits. However a good proportion of July 2020 to March 2022 and pre March 2018 saw profitability in the range of 40 and 100 USD/Day for 1 GHash/s.

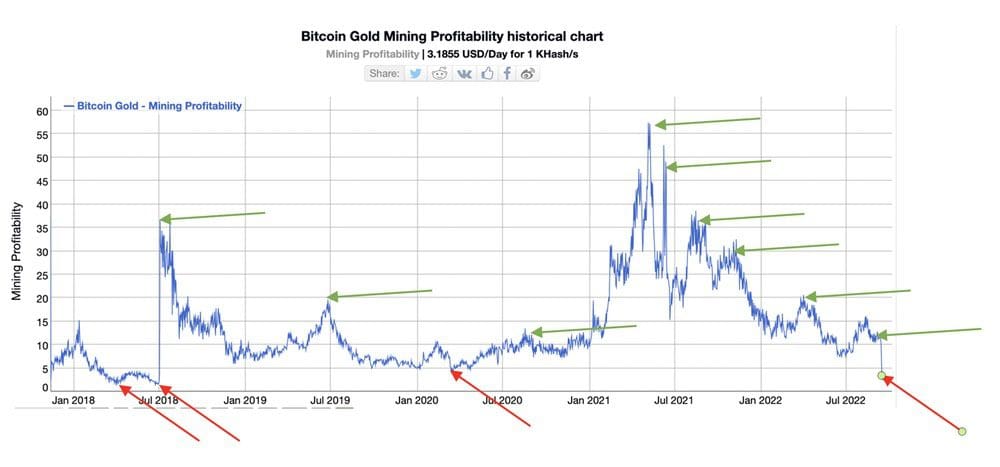

Bitcoin and Bitcoin Gold

Similar patterns can be seen with Bitcoin mining, which relies on ASIC miners. Rather than focus on Bitcoin, we thought it would be interesting to look at Bitcoin Gold (BTG) which can be mined using GPU mining equipment.

BTG mining profitability 2018 to 2022

Image credit – https://bitinfocharts.com/comparison/mining_profitability-etc.html#alltime

For BTG, we are currently seeing profitability at 3.1855 USD/Day for 1 KHash/s. However, this isn’t the lowest BTG has seen. Between April 2018 and June 2018, BTG went as low as 1.69 USD/Day for 1 KHash/s on several occasions.

What factors influence crypto mining profitability?

We can fairly safely conclude that while profitability is certainly low right now, but it’s not the first time this has happened. Mid 2018 to Mid 2020 was a particularly bad period for Ethereum profitability and similarly bad for Bitcoin.

As mentioned briefly above, there are many factors that contribute to profitability but here is a fuller breakdown:

1. Cryptocurrency prices (what you can earn)

The most obvious factor is the price of crypto, as this is directly proportional to profits that can be made. As we have covered above in various charts, prices can fluctuate massively depending on whether we are in a bull or bear market. It’s not uncommon to see crypto prices change by 10% or more in a single day.

2. Equipment

Whether choosing ASIC mining or GPU mining, the equipment plays a large role in profitability and key characteristics to consider are:

- Cost and availability – what you pay for the equipment will have a direct bearing on how quickly you start to make an ROI. Bear in mind, the cost of equipment goes up with demand and the availability comes down. You will always find the best range and value equipment during a bear market when profits are low. This will put you in a stronger position to make an ROI when price go up.

- Longevity of equipment – not only how long your equipment will last but how long it will stay profitable.

- Resale potential – research carefully the pros and cons of ASIC miners and GPU miners. Most importantly, ASIC miners limit your choice of cryptocurrency as they are dedicated to that token. If Bitcoin were to switch to PoS (not likely), you would lose you investment and it would have no resale value. If Ethereum switches to PoS (it did), your equipment can mine many alternative cryptocurrencies and will still hold its resale value if you decide to sell. Gamers for example will always be in need of GPUs.

3. Network difficulty and hashrate

Some cryptocurrencies are more difficult to mine than others, and that difficulty generally increases with time.

Bitcoin is one of the most difficult cryptocurrencies to mine. This is why it requires a dedicated ASIC miner as these can provide a much greater hashrate (computing power) than GPU mining can.

4. Power needs

The power required is directly related to above, as the power usage will increase according to the difficulty, hashrate and computing power needed. However, profitability be controlled, depending on:

- Source of power – whether you are drawing power from the grid or using green/solar energy, battery power, or perhaps even a combination of these. Some miners choose to have their equipment hosted by a third-party, which can be cheaper than the cost of paying for electricity. A fascinating example is farms with AD (anaerobic digestion) plants, essentially providing electricity using cow manure have also started to offer crypto hosting as a service

- Costs – where you live in the world, your energy supplier, your tariff and the cost of electricity at any given time – the current electricity crisis being experienced in the UK and elsewhere is making it very difficult to stay profitable if you rely solely on the grid.

5. Other costs

To mine crypto, there are other costs that need to be factored in. These can include pool fees, exchange fees, costs for your mining OS/software, and even additional equipment that may be needed e.g. fans and air conditioning to control heat.

Why do people think crypto mining is dead?

We’ll cover this more in the next section, but many miners in the UK will have seen their daily income drop to a tiny 10% of what it was before the Ethereum merge. £45 per day is now more like £4.5 per day or less – and this isn’t even taking into account electricity costs, which are going up. For most, this means they can’t break even right now.

In recent times, we had seen income halved as a result of different factors, but nothing to this extent. For new miners, this will feel very much like crypto mining is dead. For seasoned miners, this will be familiar territory.

The Ethereum merge has come at an optimal time for those opposed to crypto mining. Right now, the incentive not to mine is stronger than ever and stems from three-fold and quite compelling facts:

Ethereum can no longer be mined

The Ethereum merge has in turn led to the hash-power which once fuelled ETH mining to flood the market and go into other minable cryptocurrencies.

The result?

a) Prices have dropped for many cryptocurrencies

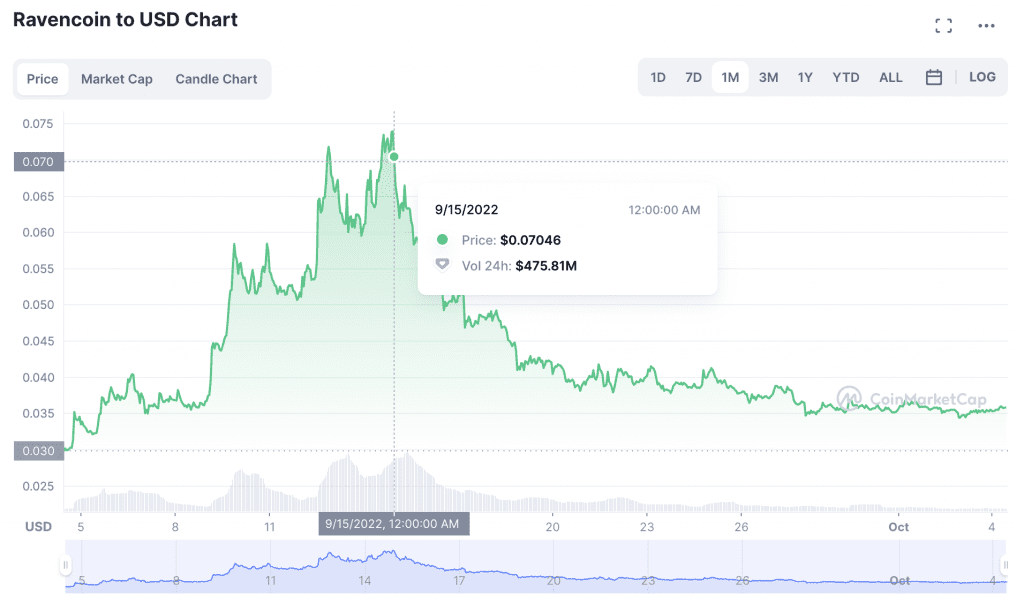

Below are two examples which clearly show a price drop following the merge date of 15th September 2022.

RVN price drop after the merge

ETC price drop after the merge

b) Difficulty has increased and profitability has decreased

The influx of hash-power to other cryptocurrencies has increased difficulty (essentially competition), meaning less income can be generated per day using the same mining equipment. Combined with point 3 below, this now means that miners are no longer making an ROI.

The Ukraine war and impact of the energy crisis on crypto

There are various reasons for increase in energy prices, but the most well-known is a result of the Ukraine conflict. Restrictions placed on Russia for invading Ukraine has led to Russia stopping or reducing the supplies of gas to many in the West.

In the UK, the average household has seen its energy costs rise by 54% from £1,277 a year to £1,971. (Ofgem, 2022). It’s expected that from October, the average home will see an increase from £1,971 to £2,500 in annual energy costs, an additional 27% increase. This would be an increase of 80% or more and we’re expecting to see costs of 51 p/kWh for electricity, up from an average of 18.9 p/kWh in 2021.

The result? Many minable cryptocurrencies are already making a loss.

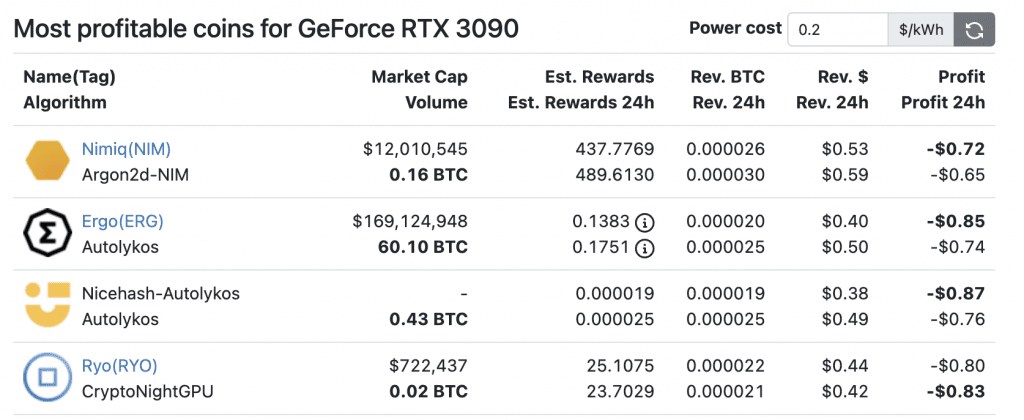

The below table shows the profitability (post merge) of a single Nvidia 3090 GPU retailing anywhere between £1,000 and £2,5000 and using approx. 18.9 p/kWh. All cryptocurrencies are making a loss:

Nvidia 3090 GPU earnings at approx. 18.9 p/kWh.

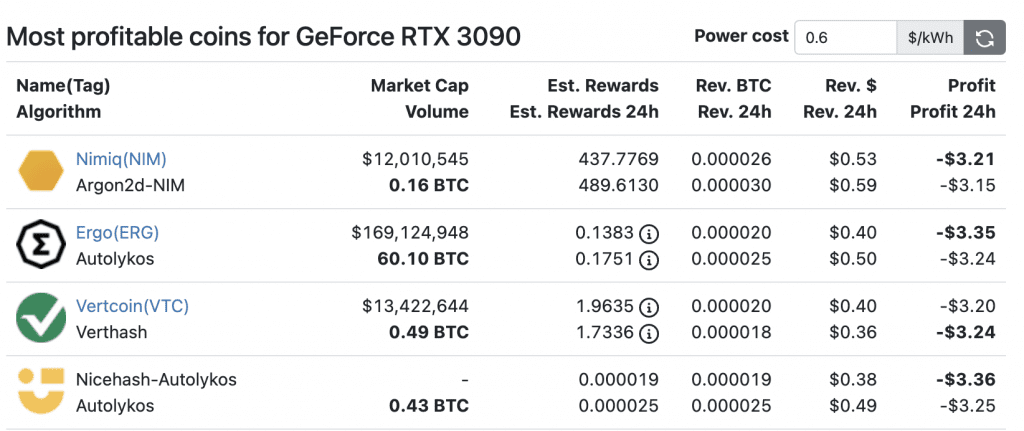

These same cryptocurrencies will be making an even greater loss if nothing changes and power costs increase to 51 p/kWh:

Nvidia 3090 GPU earnings at approx. 51 p/kWh

Environmental concerns

There are also valid but quite possibly over-exaggerated concerns over the environmental impact of crypto mining.

Many prominent figures in governments using using environmental concerns to oppose crypto mining, but is it the only reason? Again, this is best left for a future topic of discussion but there are many other reasons why governments and controlling bodies would be opposed to crypto, especially projects that are truly de-centralised.

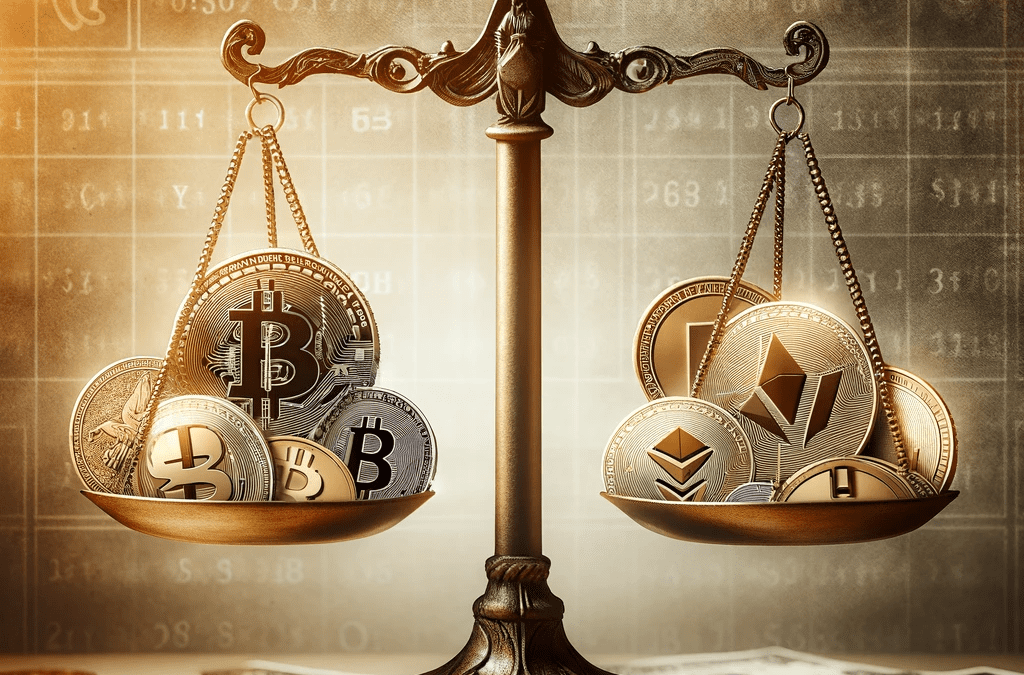

PoS vs PoW crypto mining pros and cons

Very simply put, PoW involves computing power (mining power, hash-power or hash rate) to solve complex mathematical problem in order to verify blocks on the blockchain. PoS works on the principle of staking which gives owners the right to check new blocks and add them to the blockchain.

There is a good article on this here – https://river.com/learn/proof-of-work-pow-vs-pos-proof-of-stake

Proof-of-Work |

Proof-of-Stake |

| Global – PoW is a peer-to-peer network where a global community of miners contribute their computing/hash power to maintain the network and confirm transactions – technology and user benefit | Environmentally friendly – PoW uses a lot more energy to do verify one block, while PoS is able to do that same function at a small fraction of the energy PoW uses by simply locking coins in a specific smart contract on the blockchain – environmental and human benefit |

| Security – In cases like Bitcoin, PoW converts energy into security. For this reason, many consider the energy consumption to be worthwhile. Most cryptocurrencies also have difficulty adjustments which helps to enhance security and discourage attacks. For Bitcoin in particular, immutability is one of its key benefits, making it “impossible for any entity (for example, a government or corporation) to manipulate, replace, or falsify data stored on the network” according to academy.binance.com – technology and user benefit |

Speed – PoS transactions are faster and relatively inexpensive but this comes at the cost of security– technology benefit

|

| Rewards – Miners earn rewards/income as an incentive for their service – user benefit | Staking – Stakes act as a financial motivator for PoS – user benefit |

| Track Record – PoW is well tested, has a proven track record and has been established much longer then PoS – technology benefit | Evolution – PoS has evolved from PoW and is considered to have several improvements, in particular energy consumption – technology and user benefit |

| Decentralisation – PoW is de-centralised, meaning it is global, more resistant to censorship and can provide greater protection for its users – user benefit | Centralisation – PoS is more centrally controlled meaning the rules of the network can be changed by a smaller number of individuals with the capital to do so – political benefit |

| Fairness – The absence of a controlling body to determines the rules, combined with the randomness of the SHA-256 cryptographic hash function underpinning PoW, means it is considered fairer – technology and user benefit | |

| Catalyst for renewable energy – Despite the environmental concerns of crypto mining from the grid, crypto mining has actually been a catalyst for renewable energy projects. Many smaller miners have invested in green energy using solar and/or win. Some mining farms are now powered using spare electricity produced by hydroelectric dams and others even planning to use geothermal/volcanic energy. |

Does PoW mining have a future?

It’s important to realise that today’s crypto and projects that use PoW crypto mining largely stems from Bitcoin. They use the PoW mechanism because of its many proven benefits (e.g. security) and principles of de-centralisation and fairness.

What we expect will happen is a shift – following Ethereum’s switch to PoW, other projects will move to PoS if the benefits outweigh the positives. However, many will still continue to believe in (and rely on) the benefits provided by PoW, meaning they will continue as they are. Bitcoin being a prime example.

What is most profitable to mine post the Ethereum merge?

This will depend largely on the factors mentioned covered here, some of which will be out of our control and others we can control.

The most obvious factor we can control is the cryptocurrency we chose to mine. The difficulty here is that the entire crypto landscape has been tipped on its head and is still very much in a state of flux (no pun intended – I’m not recommending Flux).

However, we have recently seen new Ethereum forks appear, such as:

Both of these forks continue to be minable and hope to continue the legacy of Ethereum as a PoW blockchain. It’s still very early days and these would be considerably more risky than lets say Ethereum Classic (ETC) which has a proven track record. Additionally, well-established tokens like ETC are supported by major exchanges like Binance and Coinbase.

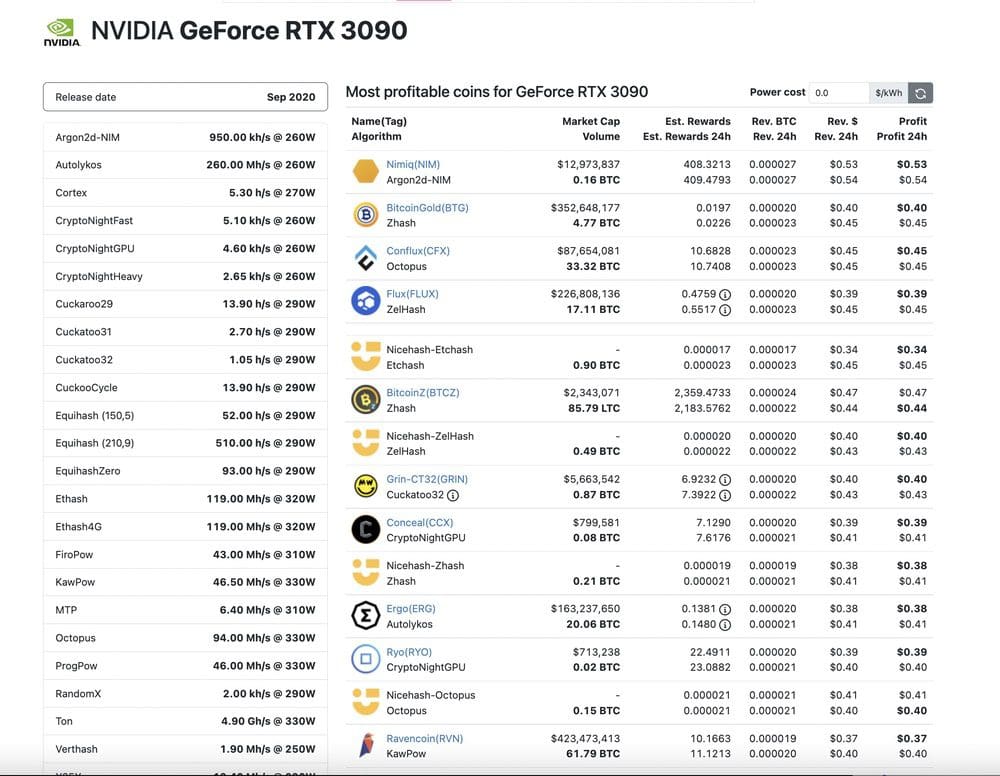

A tool every crypto miner should know is https://whattomine.com as this will show which cryptocurrencies are most profitable on any given day. Assuming you are lucky enough to be independent of the grid and have 100% green energy, you can set the power cost to zero.

The below table shows that as of 07.10.22, Nimiq is the most profitable coin to mine. However, you will need to consider more than just profitability. For example:

Do you believe in the project?

Arguably, this not important if all you focus on is what’s most profitable at any given time. This is a strategy used by some miners and involves constant switching between coins based and usually converting the income to GBP, USD or a stablecoin.

For others, believing in the project matters, because we prefer to stick to projects we like and HODL. The perceived daily income matters much less in this scenario as we simply sit on our crypto until prices take off and we then have the luxury of choosing when to sell.

Does the crypto have a track record?

As mentioned above with ETC, the track record matters if your strategy is to HODL.

Is the crypto supported by exchanges?

This doesn’t matter for everybody as many miners are happy to deposit their earnings to a wallet like Metamask.

Most profitable coins using a single 3090 GPU as of 07.10.22

Image credit- https://whattomine.com

What is in store for the future of crypto mining?

As we have seen with the previous price cycles of Bitcoin and profitability charts, the dynamics can always change.

For example:

- More people might stop mining, meaning the hash power reduces along with the difficulty. We’ve even seen cases where a whole country (China) has tried to ban crypto mining and this can have a huge impact.

- Crypto prices can change at any time and it can happen suddenly, sometimes due to a single announcement or piece of news, interest rates, or wales buying or selling large amounts of crypto. The announcement that Tesla were excepting Bitcoin payments had an almost instant impact, a decision which was of course reversed.

- Worldwide and economic conditions can change at any time and this is likely to have a direct impact on energy costs and financial markets as a whole.

- New PoW projects could take off in much the same way that Ethereum did. Those who are not involved early will miss out on the greatest gains to be made. Those who try to get back into crypto mining will be forced to buy equipment at higher costs as the level of demand will be higher.

- The Ukraine crisis combined with environmental concerns could force countries to explore and adopt more green energy sources and explore new and innovative ways to generate renewal energies. With environmental concerns and energy costs done, PoW is back on the table and less of an environmental concern.

Are you better buying or mining?

Taking a short-term view, you would be better of buying crypto right now, but this could change very quickly.

We certainly wouldn’t advise giving up on crypto mining and selling equipment. If you were to sell right now, it would be in a bear market when everybody else was selling at rock bottom prices. If/when crypto mining takes off again and you decide to re-enter the market, you would be buying at peak prices.

Remember crypto mining is an investment, not only in terms of the income you generate but GPU mining equipment will always have a value. Many mining rigs that we generating crypto years back and still working and generating an income today.

Conclusion

It’s probably clear from everything covered that we feel crypto has a great future ahead. PoW has more benefits than PoS, which would suggest that crypto mining still has a bright future and is far from dead.

That doesn’t mean that environmental concerns are invalid or should be ignored, but it does mean that alternative solutions to power crypto mining should be explored. For most miners at home or those running small mining farms, this will most likely mean researching and investing in alternate forms of energy.

There is also the potential to use green energy suppliers, eco tariffs and battery storage to further reduce the cost of mining crypto and draw from green energy sources.

More than this, and somewhat ironically, the very debate over crypto mining and energy usage is already becoming a catalyst for renewable energy. As a result, more users are adopting green energy and this is driving innovation in the green energy space. It’s foreseeable that in the not-too-distant future, crypto mining is looked back on as a key driver in reducing worldwide reliance on fossil fuels, increasing green energy adoption and moving us to new and innovative forms of renewable energy.

Last modified on: April 17, 2025

Latest Posts

GPU Mining, ASICs & Decentralisation Explained

IntroductionMining cryptocurrency has become a popular way to participate in the crypto and blockchain space while...

Basic Economics & Cryptocurrency Valuation

Why I've Written This Article? One of the most common, and most frustrating, objections (misconceptions) that I hear...

About CryptosRUs and Into the Cryptoverse

This post exploring CryptosRUs vs Into the Cryptoverse for free crypto advice is a little different to others we...

From Everyday People & General Adoption to the Bitcoin Elites: Who Will Benefit the Most?

IntroductionOn 6th September 2023, we published a massive article titled ‘Detailed Analysis of Projected Bitcoin...

Contact us to order your crypto mining rig today

Address

Opace Ltd t/a Crypto Mining Solutions, Park House, Bristol Rd South, Rubery, Birmingham, West Midlands, B45 9AH. UK

Phone

0845 017 7661