Bitcoin Adoption, Holders & Power Players: Can Bitcoin Make Millionaires out of Randomers?

With a max predicted Bitcoin price of $500,000 by the end of 2025, lets uncover the Bitcoin power players and possibility of the average Joe to become a millionaireFrom Everyday People & General Adoption to the Bitcoin Elites: Who Will Benefit the Most?

Introduction

On 6th September 2023, we published a massive article titled ‘Detailed Analysis of Projected Bitcoin Prices During 2023, 2024, 2025 & the Impact of the 2024 Halving‘. We aimed to provide a detailed insight into all of the factors that can impact Bitcoin’s price and whether predictions can be made using different models. Coming in at over 10K words, the decision

This guide titled ‘Bitcoin Adoption, Holders & Power Players: Can Bitcoin Make Millionaires out of Randomers?‘ is part of the series focusing specifically on Bitcoin adoption, the “powers that be”, and what will be allowed to happen.

Bitcoin adoption – individual holders vs the power players, who’s in control?

If you would like to jump to one of the articles, please visit below:

- Bitcoin Halvings & Future Bitcoin Price Prediction – 2024 Halving (Before & After) & 2025

- Bitcoin Price Models Compared & Their Accuracy: Is Bitcoin a Bargain?

- External Factors that Impact The Price of Bitcoin: Influencers & Influences

Why did we start writing about this?

As a company involved with crypto, notably the building of crypto mining rigs, we obviously have a vested interest and passion for crypto. However, remaining confident in the price potential of Bitcoin and the future of crypto as a whole is a challenge for even those of us with the strongest stomachs.

To cut a long story short, the data analysed in the various articles above predicts a potential maximum Bitcoin price of $500,000 by the end of 2025. This seems almost impossible to believe. So much so, that one of the more sceptical members of our team commented:

“The thought of Bitcoin going up to 500k just seems laughable to me. Not because it can’t or shouldn’t, but because it won’t be allowed to. It’ll make crypto millionaires out of randomers. I just can’t see it ever happening.”

Theorising that the price prediction could come true, the premise of this specific article is to explore the question of “will the powers that be allow this to happen”. Let’s explore…

Who holds the most Bitcoin and crypto assets?

When considering the “powers that be” and potential Bicoin adoption, it’s essential to ask questions such as “who will gain the most”, “what control will they have”, and “what will they allow”. The final two questions are somewhat subjective as it’s impossible to substantiate how much control any one entity can have when it comes to Bitcoin and crypto as a whole, but they’re all interesting to explore.

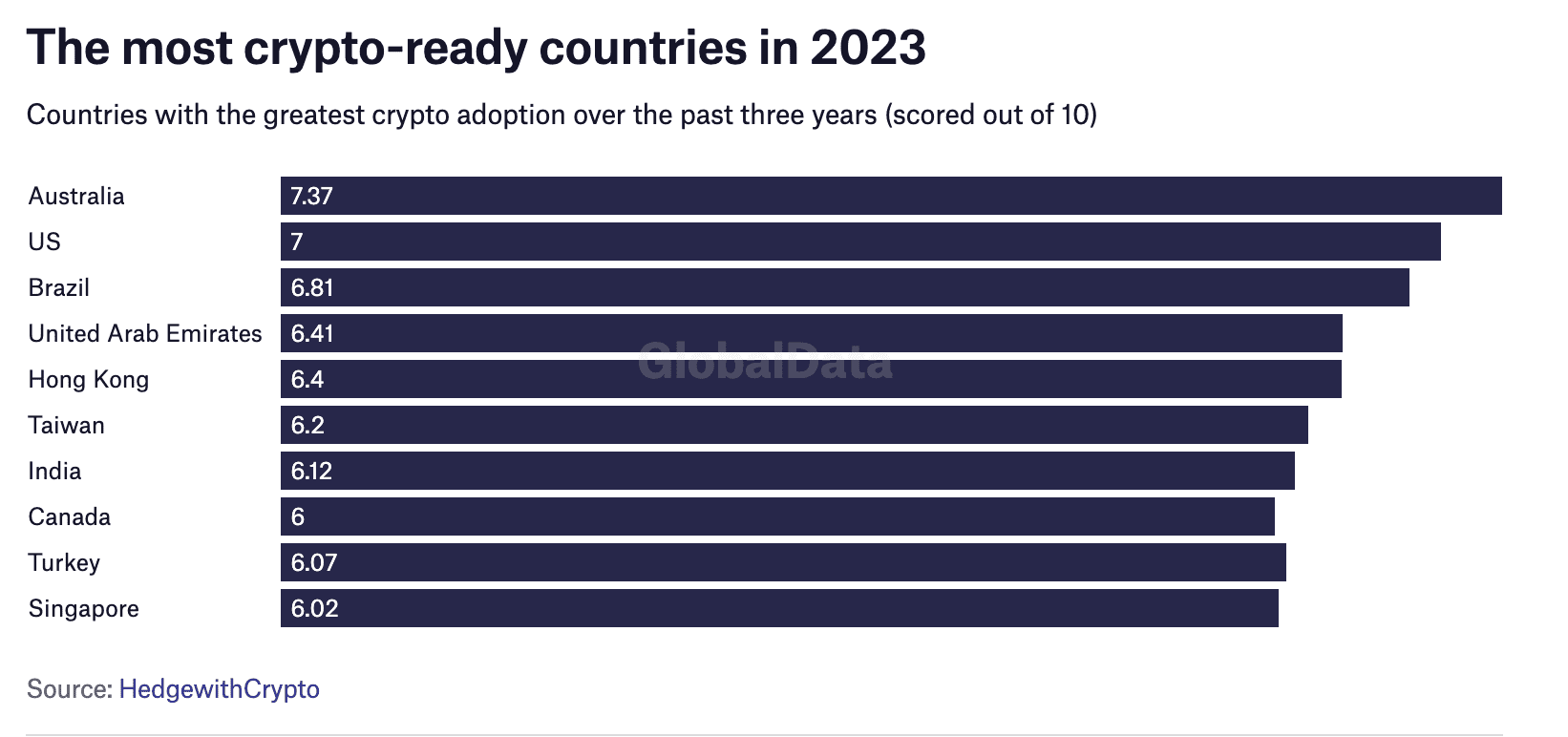

Bitcoin adoption in crypto-ready countries

When considering Bitcoin adoption, certain countries are at the forefront of accepting crypto. Based on a chart from HedgewithCrypto, the countries most prepared to embrace crypto in 2023 include Australia, the US, Brazil, the United Arab Emirates, Hong Kong, Taiwan, India, Canada, Turkey, and Singapore.

Crypto ready countries

Banks and exchanges involved within the crypto space

Several banks and exchanges are deeply involved in the cryptocurrency space:

Banks:

- Morgan Stanley: Invested $1,100 million in 2 rounds.

- Goldman Sachs: Invested $698 million in 5 rounds.

- BNY Mellon: Invested $690 million in 3 rounds.

- Commonwealth Bank of Australia: Invested $421 million in 4 rounds.

- Citigroup: Invested $215 million in 6 rounds.

Exchanges:

- Revolut: Offers crypto products and access to over 90 cryptocurrencies.

- Monzo: Enables cryptocurrency purchases from various exchanges.

- Juno: Combines a cryptocurrency exchange with banking services.

- SoFi: Supports trading for Bitcoin, Ethereum, Dogecoin, Cardano, and more.

- Fidor: Allows users to connect third-party accounts and has a partnership with Kraken.

The most prominent cryptocurrency exchanges that hold Bitcoin are Binance and Bitfinex, each holding large amounts of Bitcoin, with custody of over 600,000 and 200,000 BTC respectively.

Bitcoin financial institutions and cryptocurrency exchanges

Coinbase, a major exchange, held $55.6 billion in BTC on behalf of customers in its 2023 Q1 filing. The exchange invests up to 10% of net income into a diversified portfolio of crypto assets, holding $261.5 million worth of BTC.

People (whales)

The largest holders of Bitcoin, often referred to as “whales,” include various individuals who have amassed significant amounts of the cryptocurrency.

The Bitcoin whales and power players

Some notable individuals and their estimated Bitcoin holdings include:

- Satoshi Nakamoto: The pseudonymous founder of Bitcoin, is believed to hold around 1,000,000 BTC, valued at approximately $27.13 billion.

- Changpeng Zhao (CZ): Estimated net worth of $13.1 billion.

- Brian Armstrong: Forbes estimated his net worth to be $2.4 billion.

- Jed McCaleb: Estimated value of Ripple tokens held is $20 billion.

- Chris Larsen: Estimated net worth of $2.5 billion.

- Tyler and Cameron Winklevoss: Founders of Gemini crypto exchange, with a Bitcoin holding of around 70,000 BTC, valued at about $18.67 billion.

- Michael Saylor: Publicly revealed possession of 17,732 BTC.

- Tim Draper: Owner of 29,656 Bitcoins recovered by the U.S.

Public and private companies

Various companies, both public and private, have accumulated significant Bitcoin holdings:

- Private companies have actively acquired Bitcoin, holding about 316,067 BTC (roughly 1.5% of the total supply).

- Gox is the largest private holder with 141,686 Bitcoin yet to be distributed. Block.one, a Chinese corporation, holds 140,000 BTC, while Stone Ridge Holdings Group owns approximately 10,000 BTC. Tether Holdings LTD controls 52,670 BTC.

Some of the main publicly traded companies are:

- Microstrategy: Holds more Bitcoin than any other public company, with over 152,000 BTC.

- Robinhood Markets: Controls 118,300 BTC through a Bitcoin-accumulation strategy.

- Marathon Digital Holdings: Owns 11,466 BTC and has sold some in March 2023.

- Tesla, Inc.: Holds 9,720 BTC, having sold over 33,000 BTC since its initial purchase.

- Hut 8 Mining Corp. and Block Inc.: Hold over 8,000 BTC each.

For a more detailed view, explore the table below.

| Company | Country | Total Bitcoin | Entry Value (USD) | Today’s Value (USD) | % of Total BTC Supply |

| MicroStrategy Inc. | US | 152,800 | $4,127,000,000 | $3,925,629,008 | 0.728% |

| Marathon Digital Holdings | US | 12,964 | $189,087,000 | $333,061,875 | 0.062% |

| Galaxy Digital Holdings | US | 12,545 | – | $322,297,225 | 0.06% |

| Coinbase Global, Inc | US | 10,766 | $207,783,800 | $276,592,421 | 0.051% |

| Tesla, Inc. | US | 10,500 | $336,000,000 | $269,758,538 | 0.05% |

| Hut 8 Mining Corp | CA | 9,315 | – | $239,314,360 | 0.044% |

| Block Inc. | US | 8,027 | $220,000,000 | $206,223,979 | 0.038% |

| Riot Platforms, Inc | US | 7,094 | – | $182,254,006 | 0.034% |

| Hive Blockchain | CA | 2,332 | – | $59,912,087 | 0.011% |

| NEXON Co Ltd | JP | 1,717 | $99,974,042 | $44,111,944 | 0.008% |

| Voyager Digital LTD | CA | 1,239 | $7,927,182 | $31,831,507 | 0.006% |

| Aker ASA (Seetee AS) | NO | 1,170 | $58,599,450 | $30,058,809 | 0.006% |

| Meitu | HK | 941 | $49,500,000 | $24,175,503 | 0.004% |

| Coin Citadel Inc | US | 513 | $184,390 | $13,179,631 | 0.002% |

| Advanced Bitcoin Technologies AG | DE | 254 | $2,117,978 | $6,525,587 | 0.001% |

| BIGG Digital Assets Inc. | CA | 239 | $2,690,387 | $6,140,218 | 0.001% |

| DigitalX | AU | 150 | $610,350 | $3,853,693 | 0.001% |

| The Brooker Group | TH | 122 | $6,600,000 | $3,142,451 | 0.001% |

| Mode Global Holdings | UK | 85 | $975,089 | $2,183,760 | 0.0% |

| Neptune Digital Assets Corp. | CA | 75 | – | $1,926,847 | 0.0% |

| FRMO Corp. | US | 63 | – | $1,618,551 | 0.0% |

| Core Scientific | US | 62 | – | $1,592,860 | 0.0% |

| Metromile | US | 25 | $1,000,000 | $649,476 | 0.0% |

| Mogo Inc. | CA | 18 | $595,494 | $462,443 | 0.0% |

| Cypherpunk Holdings Inc | CA | 0 | $3,463,136 | $3,083 | 0.0% |

Bitcoin Billionaires

- Apart from Satoshi, several Bitcoin addresses contain substantial amounts.

- Notably, four addresses each hold over 100,000 Bitcoin. Among these addresses, Binance and Bitfinex.

Governments

Whether through seizures or accumulation, governments hold substantial amounts of Bitcoin, including the following:

- U.S. Government: Owns 207,189 Bitcoin, valued at $5 billion. FBI holds around 174,000 Bitcoins, while the U.S. Marshals Service has auctioned over 185,000 Bitcoins.

- China: Holds around 194,000 BTC.

- Bulgaria: Holds over 200,000 BTC.

- Ukraine: Privately holds roughly 46,351 BTC.

- El Salvador: Holds 2,381 BTC.

When considering the price of Bitcoin, speculation arises regarding potential earnings as the US government plans to liquidate its crypto holdings throughout 2023, selling 41,465 BTC in multiple batches.

ETFs and funds

Collectively, ETFs and funds own around 819,125 BTC, equivalent to 3.9% of the total Bitcoin supply.

The largest holder is Grayscale Bitcoin Trust (GBTC) with 643,572 BTC. CoinShares’ Bitcoin Tracker One XBT holds approximately 37,603 BTC. When combined with public and private company holdings, these entities own nearly 1.5 million BTC, surpassing 7% of the total supply.

Additionally, BlackRock, the world’s largest asset manager, has invested a part of its $15 billion fund into Bitcoin.

Sources

- Hedgewithcrypto (Crypto Adoption): Source

- Investopedia (Satoshi Nakamoto): Source

- Bybit (Whales and Ownership): Source

- Mpost (Crypto Billionaires): Source

- River Financial (Bitcoin Ownership): Source

- Statista (Crypto Billionaires): Source

- CoinGecko (Public Companies): Source

- Arkham Intelligence (Bitcoin Holdings): Source

- Forbes (US Government Bitcoin Holdings): Source

Will Bitcoin make millionaires out of “randomers”?

The most important thing to realise is that while many people feel like they’ve made it by reaching 1BTC (worth a potential $500K in the coming years), this is still a very small amount compared to the individuals, companies and governments that posses thousands or hundreds of thousands of Bitcoins.

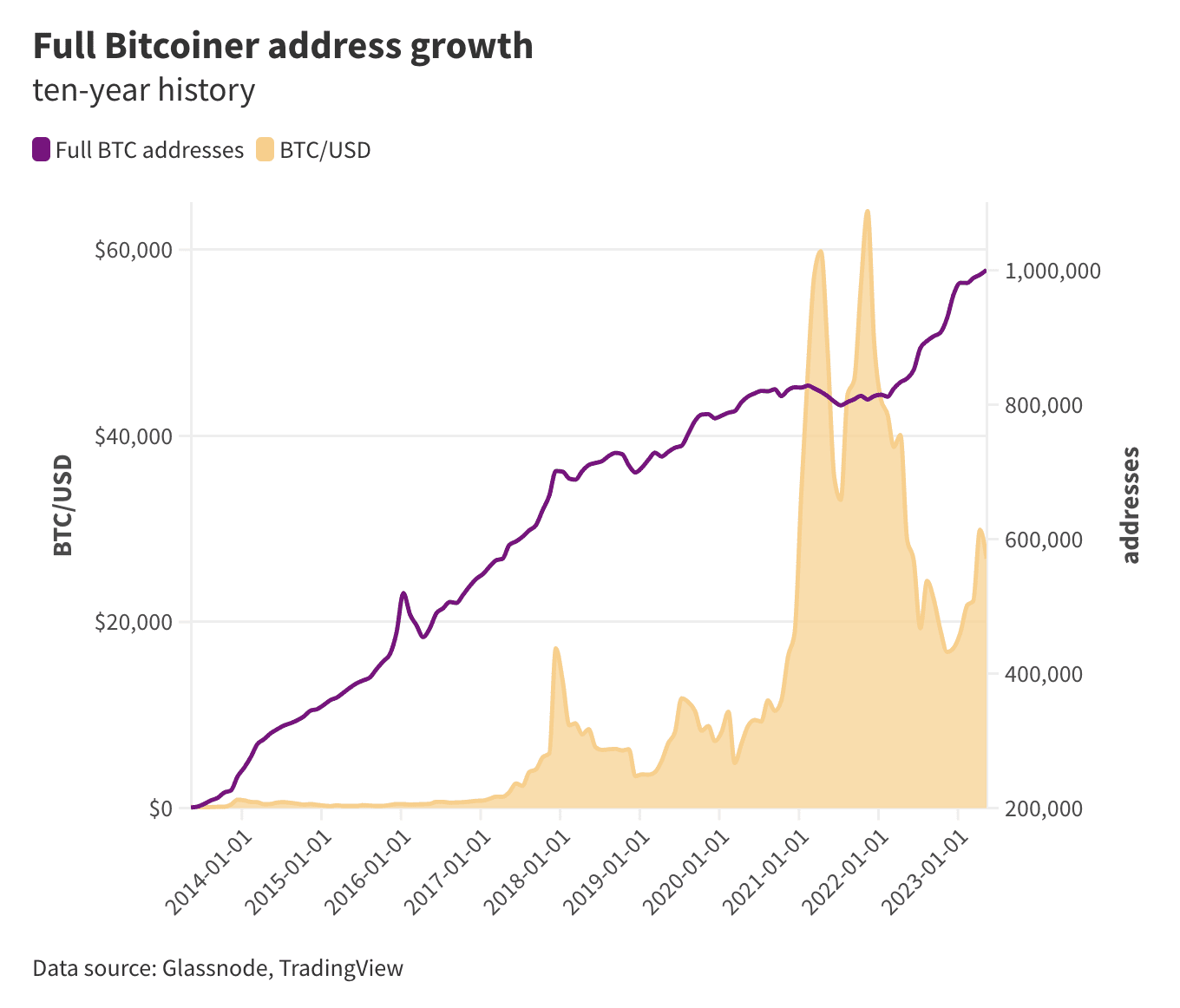

How many accounts own more than 1BTC?

The following report shows that more than 1 million addresses now hold over 1BTC and that’s not taking into account other cryptocurrencies.

Full Bitcoiner addresses growth chart

We don’t know who these addresses are or how much they hold, but the above chart shows a very clear growth in the number of addresses/users accumulating more than 1BTC.

However, it’s important to note that the Bitcoin address doesn’t necessarily represent one individual; some people control multiple addresses, and some addresses might belong to institutions or groups. We know that the individuals, companies, exchanges, and governments explored will be among these, but we don’t know what percentage represents the average retail investor who strives to accumulate 1BTC.

How many Bitcoin holders are there?

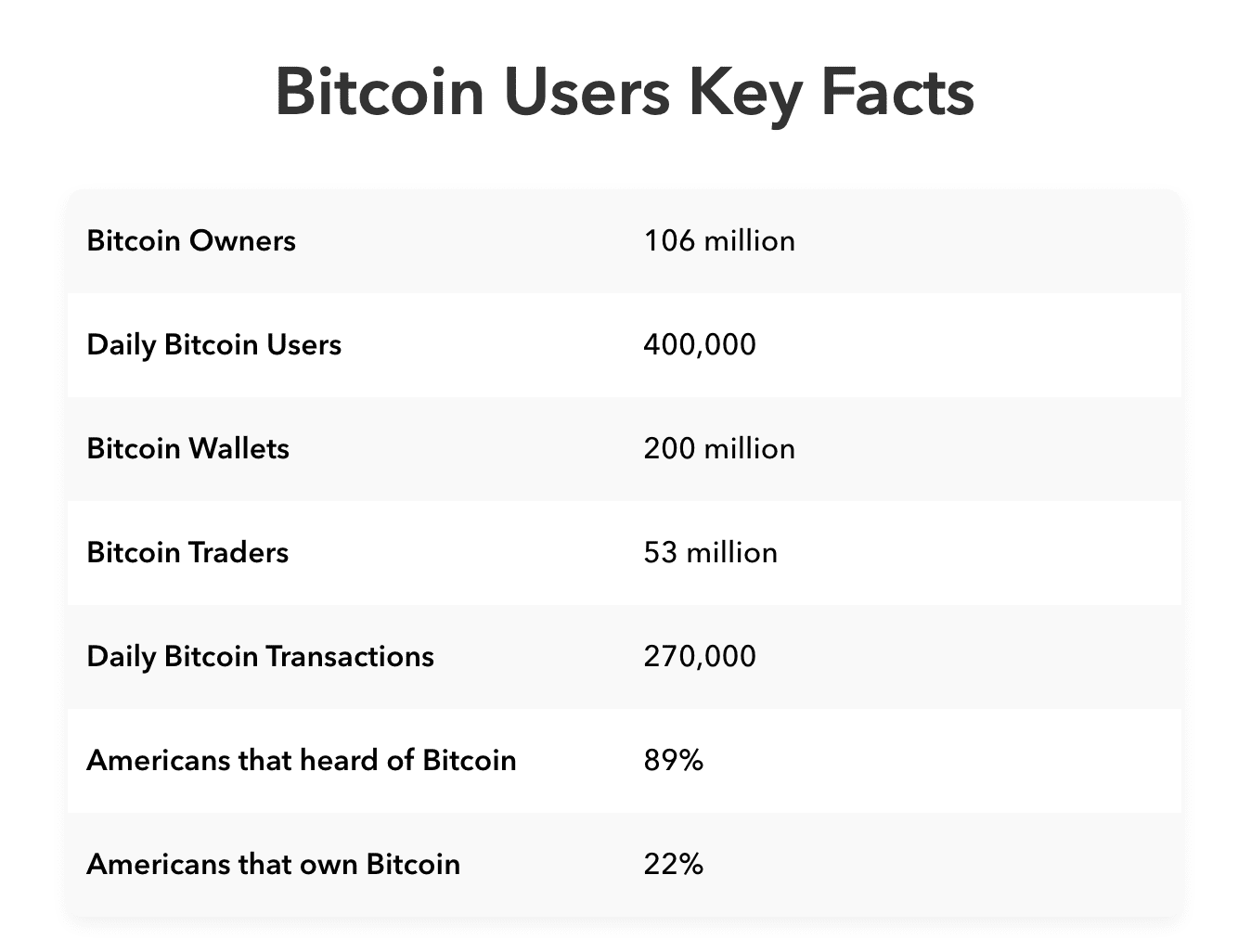

This report from Buy Bitcoin Worldwide provides some additional perspective insights into the number of Bitcoin users globally.

As of 2023, it’s estimated that there are 106 million Bitcoin owners. However, determining the exact numbers is challenging due to factors like one person having multiple addresses and centralised exchanges holding Bitcoins for multiple users.

Bitcoin key facts

Based on this, we can calculate that those that trade Bitcoin daily form:

“Less than 0.5% of the total”

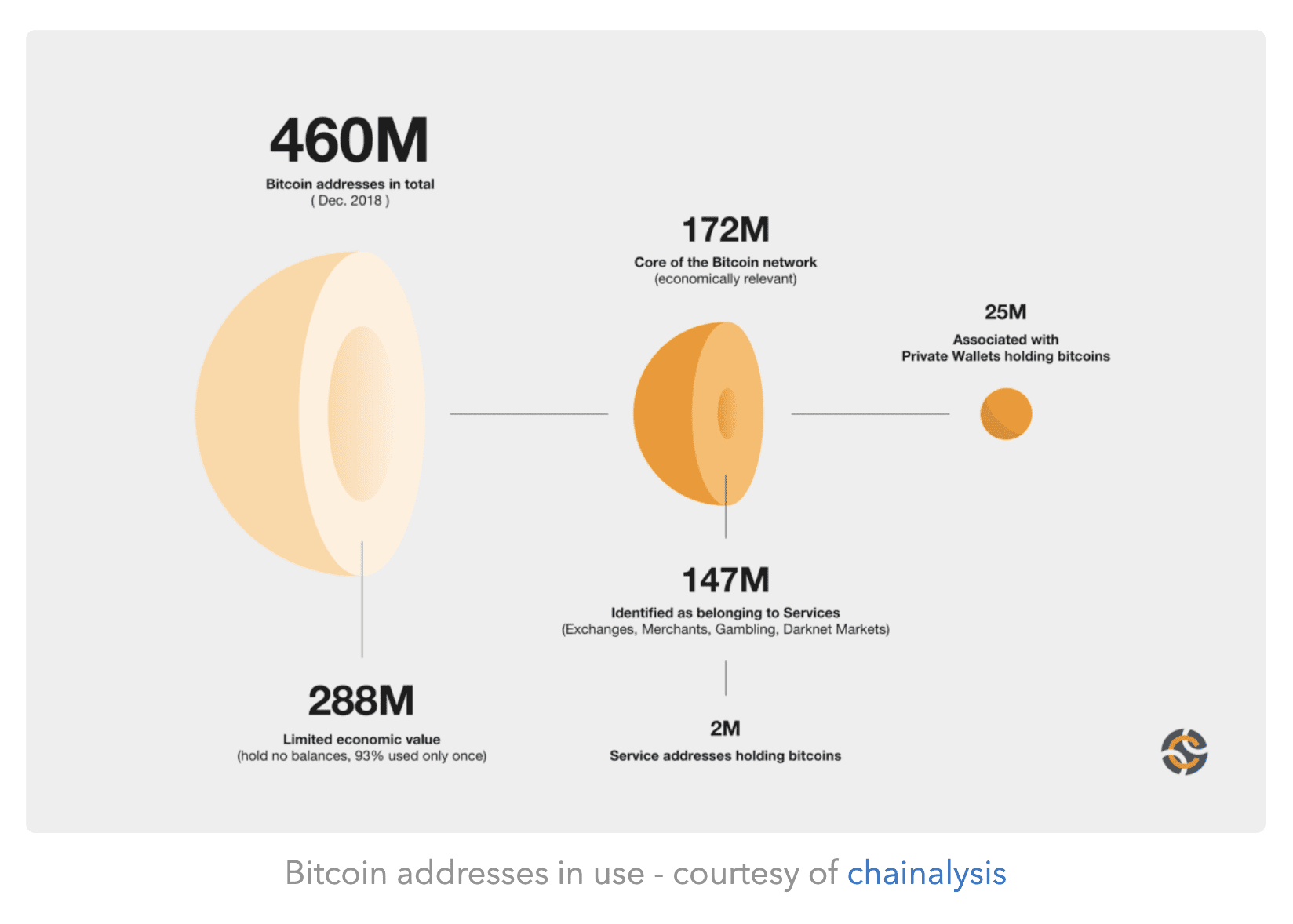

The below picture, although from 2018 provides yet another perspective on the Bitcoin addresses in use.

How many “randomers” are there?

It’s almost impossible to calculate this given many will be on exchanges rather than holding their own wallets; however, the big boys mentioned above, such as Musk (Tesla), Saylor (MicroStrategy), Catherine Wood (Greyscale), the exchanges and even governments (notably the US government) hold the greatest percentages.

In other words, despite Bitcoin’s decentralised nature, the wealth distribution is more concentrated than assumed:

- Only 7% of the total Bitcoin supply is spread across the 46.5 million addresses holding less than one Bitcoin.

- The remaining 93% is held by the one million addresses owning at least one Bitcoin.

Who has the most gain from future Bitcoin and crypto price increases?

It’s clear that those who have the most to gain from Bitcoin price changes, especially during bull runs, are:

- Individual whales and early adopters: Notable individuals such as Satoshi Nakamoto, Changpeng Zhao (CZ), Tyler and Cameron Winklevoss, and others hold significant amounts of Bitcoin. They stand to gain immensely from price surges due to their substantial holdings.

- Private and public companies: Companies like MicroStrategy, Tesla, Marathon Digital Holdings, and others have invested in Bitcoin. The value of their holdings can significantly increase during bull runs, leading to potential gains.

- Crypto exchanges: Prominent exchanges like Binance, Bitfinex, and Coinbase hold large amounts of Bitcoin in custody for their users. They earn fees from trading and custody services, and their holdings’ value rises during price uptrends.

- Cryptocurrency funds and ETFs: Entities like the Grayscale Bitcoin Trust (GBTC) and CoinShares’ Bitcoin Tracker One XBT hold substantial amounts of Bitcoin on behalf of investors. Their assets under management increase in value during bull markets.

- Governments: Governments like the U.S., China, and others have holdings of Bitcoin. As the price increases, the value of their holdings appreciates, potentially benefiting their budgets.

It’s intriguing to speculate who holds the reins and stands to benefit the most but we can expect there to be close ties between all of the above players and predict that they will act in a way to benefit themselves and their stakeholders the most.

Conclusion

Realistically, and if we see the best-case scenario play out, the average Joe who sells their 1BTC at the maximum predicted price of $500K in 1-2 year’s time wouldn’t be of any real interest to those in control, not for anything other than taxation reasons – that’s our opinion anyway.

Behind the scenes, we know there is a diverse array of stakeholders that hold the power to both shape and benefit from these price fluctuations, but they’ll be more interested in their own gigantic gains than the smaller gains of the masses. If we think about influence over the market, price, regulation, adoption, and uptake, the forces at play are intricate and have complex relationships:

- Institutional investors, wielding significant capital, have the power to move the market through substantial purchases or sales.

- Cryptocurrency exchanges are at the epicentre of trading activity and play a pivotal role in shaping market sentiment and liquidity.

- Government decisions on crypto policies can tilt the balance of Bitcoin adoption and sentiment. Favourable regulations can lead to increased adoption and price appreciation while unfavourable rulings can cast shadows of uncertainty over the market.

- Influential figures in the crypto space, such as Elon Musk, Winklevoss twins, CZ, and Michael Saylor, can shape market sentiment through their statements and actions.

The rise and fall of Bitcoin prices are shaped by so many different factors. From in-built factors like Bitcoin halving events to the external forces impacting Bitcoin’s price, it’s a complicated subject that requires looking at the big picture – something we hope to have achieved with these articles. It makes sense that those who have the most influence will keep Bitcoin prices low for as long as possible while they accumulate, and then influence markets to boost Bitcoin’s price at the right time to cash in and increase their wealth.

If Bitcoin does reach heights of $100,000 to $500,000, the beneficiaries’ outcomes will diverge. Established players with substantial holdings, like MicroStrategy and institutional investors, could amplify their wealth considerably. Governments might leverage reserves, possibly benefiting budgets or national initiatives. Retail investors, while potentially enjoying substantial gains, will still collectively have less to gain and a more modest impact on the broader market.

As the market continues to evolve, it will be those who can strategically navigate this ecosystem that stand to gain the most individually.

Last modified on: April 18, 2025

Latest Posts

GPU Mining, ASICs & Decentralisation Explained

IntroductionMining cryptocurrency has become a popular way to participate in the crypto and blockchain space while...

Basic Economics & Cryptocurrency Valuation

Why I've Written This Article? One of the most common, and most frustrating, objections (misconceptions) that I hear...

About CryptosRUs and Into the Cryptoverse

This post exploring CryptosRUs vs Into the Cryptoverse for free crypto advice is a little different to others we...

How The Price of Bitcoin is Impacted by External Drivers & Forces

Introduction On 6th September 2023, we published a massive 10K word article titled ‘Detailed Analysis of Projected...

Contact us to order your crypto mining rig today

Address

Opace Ltd t/a Crypto Mining Solutions, Park House, Bristol Rd South, Rubery, Birmingham, West Midlands, B45 9AH. UK

Phone

0845 017 7661