Is Cryptocurrency a Scam or Greatest Innovation of a Decade?

A deep dive into crypto in 2022. In our latest guide, we explore the question is crypto a scam or the greatest technological innovation since the internetIs Crypto a Scam?

Editor’s Note: 22.08.22 – Minor updates to improve the article and reference links provided for further reading.

Is crypto a scam? It’s probably the first thing people wonder when they hear about cryptocurrencies like Bitcoin. It doesn’t help that the word “crypto” often conjures up notions of secrecy and something that’s unusual. Even those of us inside the crypto space sometimes find ourselves wondering whether certain cryptocurrencies are a scam.

Let’s explore the question is cryptocurrency a scam while trying to demystify some of the misconceptions about cryptocurrency in 2022 and its associated technologies.

It is worth noting that nothing in this article should be considered financial advice. We have been working in the IT and technology sector for over 30 years, and during that time, have developed insight that we feel others will find useful.

Is cryptocurrency a scam?

To answer the question of whether crypto is a scam, we must first acknowledge that the crypto space is huge and growing at an ever-increasing rate. As a result, this means that we constantly see new projects appearing that generate huge financial investment and interest, as well as popular projects dying unexpectedly. The crash of Terra LUNA is just one recent example, more on this later.

Negative news and press

Unfortunately as of late, crypto has become synonymous with the idea of scams. This is in part due to the disproportionate press coverage given to crypto scams, and the lack of media attention given to successful and innovative projects. A lot of the population is still uneducated on the topic of cryptocurrencies, and most form a bias without researching the space.

That’s not to say, scams don’t exist in the cryptocurrency world, as they do. As with any regulated or unregulated area, cryptocurrency is subject to bad actors that, on occasion, create scam projects resulting in rug pulls. This, however, is not the case for the majority of cryptocurrencies.

Scam vs failing projects

It’s easy to confuse crypto for being a scam with news such as the collapse of Terra LUNA. LUNA is an example of a project that went from being hugely successful and trusted to almost worthless in the space of 48 hours. This happened after Terra’s stablecoin UST fell below $1 resulting in it becoming depegged. The cause was numerous huge withdrawals from a DeFi protocol running on Terra’s blockchain causing a downward spiral. Somebody, or a group of people, caused this crash.

This has led many to label the project as a ‘scam’, whereas the truth is that investing in any cryptocurrency is risky and it doesn’t carry the same stability as traditional currencies. Despite Terra LUNA not being a scam with bad intentions, these things do sometimes happen with crypto projects, which is why caution should be taken when investing.

Nefarious projects

Aside from failing projects, does this mean that the space is rife with nefarious projects? No. Think of it this way, we wouldn’t think that traditional money (Fiat currency) is ‘dirty’ just because of the huge number of criminals using it to fund illegal activities throughout the decades. We understand the nuance and realise that beneficial tools and ecosystems can sadly be utilised by those with bad intentions.

It’s easy to label any crypto project as a scam, it’s a case of ‘guilty by association’ just because there have been scam crypto projects in the past. So, is cryptocurrency a scam? No. We shouldn’t form generalisations about crypto as a whole; however, we must also acknowledge that crypto scam projects still exist and try to weed these out.

Ponzis, pyramids and other types of schemes

We won’t touch upon this in detail here. As part of our demystifying crypto series, we have covered the subjects in our below guides.

Needless to say, crypto is a complex and largely unregulated area, meaning it is subject to schemes of all shapes and sizes. As always, a great deal of care should be taken before investing in crypto and always research projects carefully. As well as the pointers in the next section relating to scams, be sure to read our section ‘how to spot a Ponzi or pyramid scheme’.

How to identify crypto scam projects?

One way to mitigate this concern is via education and research. It is important to spend some time researching any potential crypto project that you are thinking of investing in, rather than getting caught up in the hype surrounding it. Don’t succumb to FOMO (Fear of Missing Out) and simply follow the masses!

Take a moment to breathe and think about what a good crypto project would look like. Ask questions like:

- How long has the cryptocurrency project been around?

- Who runs the project and do they have a proven track record and history in the space?

- Does the project serve a purpose by providing a utility or value?

- Is the project unique or are there lots of others doing the same thing?

- Is the project team active, do they have a roadmap and have they delivered on their promises?

- Does the project have a good community and following on social platforms like Twitter, Reddit and Discord?

- Where does the cryptocurrency rank among the others and what is its market cap?

I could go on, but the more research you do, the more informed you will be. That means the less likely you will be subject to a crypto scam, but do bear in mind that all crypto projects are volatile and never risk more than you are willing to lose.

Are NFTs a scam?

Like cryptocurrencies, NFTs are thought of by many as being largely a scam. This is partly due to the recent popularity of NFTs such as the bored ape club, where some pieces are selling for as much as $3.4 million.

Although the bored ape club NFTs are not a scam, many people online are confused as to why these ‘images’ sell for so much money. A common complaint is that anyone could just screenshot and save the NFTs to their own hard drive for free. Obviously, this misses the whole point of NFTs and true digital ownership but is still a common complaint nevertheless.

Plagiarism

A more valid concern amongst those that call NFTs scams is the abundance of plagiarism rife in the space. Many NFTs have been copied, and then re-uploaded onto websites such as OpenSea.

This has become such a problem that OpenSea themselves announced recently that around 80 percent of the NFTs created through its minting tool had been considered fraudulent or plagiarised.

Unfortunately, this means that the beneficial use cases and scenarios for NFTs are overshadowed by the negative aspects associated with them. Scams and fraudulent projects, yet again, receive media attention rather than the positive and innovative technology being created in the process.

NFTs can serve many different purposes — Photo by Andrey Metelev on Unsplash

Legitimate use cases

All of that said, there are many legitimate use cases for NFTs.

NFT technology could be used to facilitate the sale of season tickets at a football club for example or to gain access to live shows throughout the year along with other benefits. This would allow businesses to offer their customers and fans much more than what is currently possible with traditional sales of tickets and merchandise.

NFTs don’t have to be just images of apes that are sold for millions of dollars. There are future use cases with the technology that could enhance the buying experience for customers spanning multiple industries.

The problem yet again is a lack of nuance as most critics treat crypto, NFTs, and blockchain technology with the same brush, failing to see the benefits of crypto and blockchain technology.

So to answer the question, not all NFTs are scams, but some projects can be fraudulent which is why, again, it is best to research thoroughly before spending any of your Fiat or crypto.

Is crypto illegal?

To save confusion, it is best to split this answer into two parts. Many people want to know if crypto is illegal generally, whereas others want to know if mining crypto is illegal.

Is buying, selling or trading crypto illegal?

Crypto in the UK and the US is completely legal when it comes to buying, selling and trading. However, some countries such as China have said that they consider all crypto transactions in the country to be illegal. Many Chinese citizens had still been using cryptocurrencies until a recent crackdown stopped Chinese investors from using foreign exchanges.

Is mining crypto illegal?

This depends. Many parts of the US, such as Texas, are home to huge mining networks and favourable policies whereas states such as New York have recently banned mining. It gets more complicated when you dig into the details, as the New York ban seems to pertain to those mining Bitcoin using carbon-based power sources only.

Elsewhere in the world, most countries that allow the trading of crypto also allow mining, although it may be just a matter of time before more laws come into place to limit this.

Is it safe to invest in crypto?

The answer to this question, it all depends on your own definition of ‘safe’.

There is always a chance that you will lose your investment if a crypto project falls apart, such as the Terra LUNA project mentioned at the start. Many people want to invest in an asset like Bitcoin in order to protect themselves from inflation.

Whilst Bitcoin, much like gold, is considered (and proven) to be a great hedge against inflation over the long term, that doesn’t mean it’s safe. The problem is, Bitcoin and crypto markets in general, are subject to huge volatility. When there are major events in the world, like COVID-19, the Ukraine war, or even the crash of Terra LUNA, this can cause crypto markets to tumble.

It is worth learning the difference between Fiat volatility and crypto volatility before investing any of your hard-earned cash.

Is cryptocurrency used for criminal activity?

A popular misconception is that Bitcoin specifically is allowing criminals to finance illegal activity.

The problem with this idea is that Bitcoin’s ledger is public, meaning it can be viewed by anyone. Most exchanges now require verification via KYC, which means it isn’t difficult to track down users that are breaking the law. Bitcoin ATMs are very rare too, meaning it would be even harder for someone to use BTC anonymously for a considerable amount of time in most countries.

Do criminals use Bitcoin and other cryptos to fund illegal activity? Photo by Towfiqu barbhuiya on Unsplash

However, not all crypto projects are created equally or with the same goals. There are some crypto projects, such as Monero, that specialise in anonymity and privacy. This is something that many of us would like; however, privacy comes at a cost. Crypto projects like Monero which allow untraceable transactions, make them more appealing to criminal activity.

Generally speaking though, most cryptocurrency projects aren’t as anonymous as some would have you believe. Many would even argue that conventional money is better suited for criminal activity as it can be drawn out and used without any record of a transaction taking place.

Is traditional Fiat currency a scam?

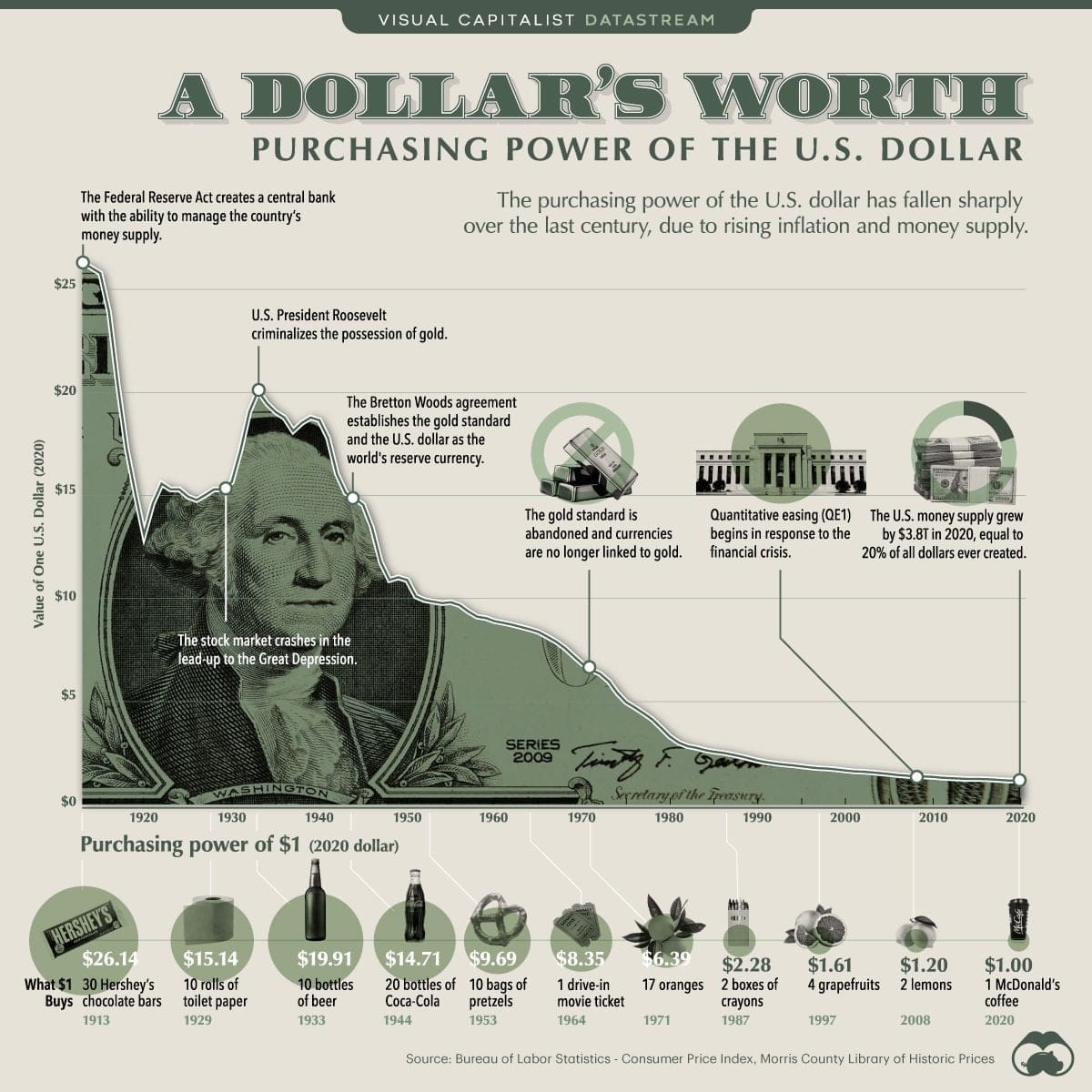

Many of the arguments used to label crypto and Bitcoin as a scam can also be applied to Fiat currencies too. Let’s start by taking a look at the history of a dollar’s worth.

Visualisation via Visual Capitalist

As you can see in the infographic above, the US money supply grew by $3.8T in 2020, which is equal to 20% of all dollars ever created. Looking at the decline of the purchasing power of the dollar over the decades, it’s easy to see why some consider Fiat currency a scam.

Back when currencies were pegged to gold via the gold standard, the printing of money was limited and this prevented issues such as inflation. It also meant that each unit of currency could theoretically be traded for its worth in gold, a commodity which is limited in supply and has been recognised as a source of wealth for centuries.

Since then, things have been in steady decline for the dollar and its purchasing power. After leaving the gold standard monetary system, the value of Fiat isn’t defined by an underlying commodity anymore meaning that seemingly endless amounts of currency can be printed.

When you look at the endless printing of money and parts of the world experiencing the highest inflation in 40 years, it is easy to see why people are looking to alternatives like crypto. Some have also claimed modern-day Fiat currency to be the greatest scam of all time, saying that if the world economy collapses we are left with another other than the paper our money was printed on. This was certainly the case in the 1920s, when Germany was struggling to recover from the war. Cash became almost worthless and children were seen playing with huge stacks of money.

We’ve written an article comparing Fiat currencies to CBDCs and cryptocurrencies, which is worth reading to better understand the differences. There are some very clear benefits come with using cryptocurrencies over Fiat, which are worth knowing about when comparing the two.

Fiat vs Bitcoin comparisons

Let’s take some of the common arguments used against Bitcoin, and see how those same arguments stack up against the use of Fiat currency:

| Bitcoin | Fiat | |

|

“BTC can fund crime via anonymity” |

Requires uncommon BTC ATMs — nearly all exchanges use KYC now. Bitcoin ledger is public and traceable. |

Can withdraw from bank and use without leaving a papertrail — ideal for criminals |

| “Bitcoin has no value” |

21 Million fixed supply |

Endless printing — isn’t tied to an underlying commodity |

|

“Bitcoin is open to manipulation and control” |

Decentralised — no central authority | Centralised — controlled by governments / banks |

|

“Bitcoin uses too much power” |

Banking system usage — 263.72 TWh per year |

113.89 TWh per year (and striving to improve via green energy) |

|

“Bitcoin isn’t as fast or as convenient as Fiat” |

Can be sent anywhere in the world almost instantly without relying on an intermediary |

Nationalised currency. International payments are subject to delays, checks, or rejection. |

How to protect yourself from crypto scams

Here are some quick ways to protect yourself from crypto scams that everyone should take note of. If you are thinking of investing in crypto, revisit our pointers about how to identify a crypto scam in the first place.

If you are concerned about being subject to a crypto scam:

- Install anti-phishing software such as Avast

- Use a hardware wallet to store your crypto

- Enable white-listing and 2FA on KYC-enabled exchanges

- Be cautious of influencer or celebrity promotions — nearly all are fake

If you are using a crypto wallet, never share your ‘seed phrase’ with anyone. This is your recovery option if you have trouble accessing your account. Never forget the message “Not Your Keys, Not Your Coins“. Making sure that you personally hold the private keywords to your cryptocurrencies, is probably one of the best ways you can protect yourself if you own crypto.

Some popular and innovative crypto projects

Despite all the talk of crypto scams and Ponzi schemes, it is important to also take note of some of the successful and innovative projects within the space.

Let’s go through some new and exciting crypto projects that are changing what is possible via blockchain technology.

Cardano

Cardnao is run by Ethereum co-founder Charles Hoskinson. Amongst other things, Cardano is currently adapting their blockchain in order to allow smart contracts that can be used to give Africans access to DeFi services. The goal here is to create an economic infrastructure that will give Africans financial inclusion.

In Charles’ own words —

“Cardano is an open platform that seeks to provide economic identity to the billions who lack it by providing decentralized applications to manage identity, value and governance”. —

Helium

A lesser-known and smaller cryptocurrency project is Helium. Helium’s blockchain functions as a peer-to-peer wireless network for IoT devices which uses ‘nodes’ to allow wireless devices to connect to the network. The native token (HNT) is awarded to those that run nodes once a device has connected and transferred data successfully. These ‘nodes’ are referred to as ‘hotspots’ when using the Helium network.

These nodes allow for a number of different services to run and grants access to the devices connected to the decentralised network. Helium is often referred to as ‘the people’s network’ and provides a secure and affordable way for low-power ‘Internet of Things’ devices to send and receive data to and from the Internet.

VeChain

VeChain was founded in 2015 by Sunny Lu, the former CIO of Louis Vuitton China. The main purpose of VeChain is to provide tracking of goods via blockchain technology. This aids businesses in reducing fraud and theft. With usage cases ranging from food safety traceability to digital Carbon footprint & sustainability, VeChain has a lot to offer.

VeChain sets out to solve the many problems inherent within logistics and the supply chain process. This technology is used across many different sectors and industries including medicine, healthcare, the automotive industry, and carbon management. It’s not just businesses that make use of this technology either, many governments also utilise VeChain in numerous different ways.

Genuine crypto projects facing criticism

Many proponents of crypto are becoming increasingly disgruntled with the way certain projects are being handled.

For example, even popular projects like Helium (HNT) have recently come under fire for the huge delays and downtime that users are facing when it comes to mining. In addition to these delays, Helium is now moving to ‘Lite hotspots’ which means reduced earnings for miners as well as Helium putting more focus on 5G. This results in miners outside of the US being somewhat limited with how they can participate in the project causing frustration in the community.

For users that are looking to start Helium mining, it’s worse as they’re being subject to actual scams with various ‘so called’ retailers either selling fake equipment or legitimate retailers like Nebra not delivering products, with many customers still waiting after 12 months or more.

A far more common frustration is with Ethereum (ETH). Its upcoming “merge” means that the project is moving from PoW (Proof of Work) mining to PoS (Proof of Stake). Many in the community are fiercely opposed to this change. Miners have invested heavily in the hardware required to mine ETH, typically spending thousands upon thousands of pounds on equipment dedicated to the process. As a result of the merge, Ethereum will no longer be minable and many miners are now on the hunt to find another cryptocurrency to mine.

These are just two projects under criticism from the community, but there are many more.

Conclusion: is cryptocurrency a scam?

Hopefully, we can now answer the question, is crypto a scam. The answer is no.

Crypto like many other financial markets is certainly subject to scams, schemes and volatility. This doesn’t mean that the whole crypto market should be labelled as a scam, especially when the large majority of projects are completely legitimate and have massive real-world potential.

The crypto space is still a relatively new and exciting new area. It’s attracting interest and financial input from around the world, ranging from non-professional retail investors at home to global corporations and investment firms.

It’s not all fun and excitement though. There are definitely some valid concerns that need to be taken into account if you are a new investor in the space or have worries over being scammed.

It’s important to realise that cryptocurrencies and their associated technologies are constantly evolving and changing. Change is an important part of these projects innovating and being successful, but these changes aren’t always popular with the community (Helium and Ethereum for example). Huge volatility is commonplace and it’s not unusual to see crypto investments grow or drop significantly. The table here shows how the top two cryptocurrencies, Bitcoin and Ethereum, have dropped over 70% in value since their peak in November 2021. Projects like Ripple (XRP) have dropped over 90%.

With all of that said, we strongly believe that crypto is the future, but that doesn’t mean that any and every project will be successful or legitimate. A huge amount of care should be taken when spending any of your personal finances.

Hopefully, you now have a better understanding of crypto as a whole, and how a few small negative projects can impact how people think about the space as a whole.

Reference material

To help you understand scams in more detail and further assess the question, is cryptocurrency is a scam, please check out our additional reference material below:

https://www.moneyhelper.org.uk/en/money-troubles/scams/a-beginners-guide-to-scams

https://www.citizensadvice.org.uk/consumer/scams/check-if-something-might-be-a-scam/

https://www.investopedia.com/articles/00/100900.asp

https://stacker.com/stories/2525/30-biggest-scams-modern-history

Last modified on: December 15, 2025

Latest Posts

GPU Mining, ASICs & Decentralisation Explained

IntroductionMining cryptocurrency has become a popular way to participate in the crypto and blockchain space while...

Basic Economics & Cryptocurrency Valuation

Why I've Written This Article? One of the most common, and most frustrating, objections (misconceptions) that I hear...

About CryptosRUs and Into the Cryptoverse

This post exploring CryptosRUs vs Into the Cryptoverse for free crypto advice is a little different to others we...

From Everyday People & General Adoption to the Bitcoin Elites: Who Will Benefit the Most?

IntroductionOn 6th September 2023, we published a massive article titled ‘Detailed Analysis of Projected Bitcoin...

Contact us to order your crypto mining rig today

Address

Opace Ltd t/a Crypto Mining Solutions, Park House, Bristol Rd South, Rubery, Birmingham, West Midlands, B45 9AH. UK

Phone

0845 017 7661

Im telling you, crypto is the future! Embrace the uncertainty and lets ride the wave!